The Indian MSME lending landscape is undergoing significant changes. As we step into 2025, regulatory pushes, technological leaps and shifting customer expectations are reshaping the industry. Borrowers now expect financial services that are not only faster but also more personalised and secure.

Trends such as real-time payments and digital wallets are becoming mainstream, fuelled by growing consumer expectations, easier access to credit and increased foreign investments. These developments are encouraging financial institutions to rethink their strategies and adopt solutions that enhance their agility and customer-centricity. Innovations like AI-driven decision-making and automation are revolutionising lending operations, making them more efficient, scalable and compliant.

India’s digital lending market is projected to reach approximately $2.4M by 2030, growing at a CAGR of 29% from 2024 to 2030 (Grand View Research). With this rapid growth, lenders need to automate key processes, such as loan origination, underwriting and collections to improve productivity, reduce errors and enhance the borrower experience.

Let us explore 2025’s top trends shaping the future of MSME lending and identify the processes financial institutions must automate to stay ahead.

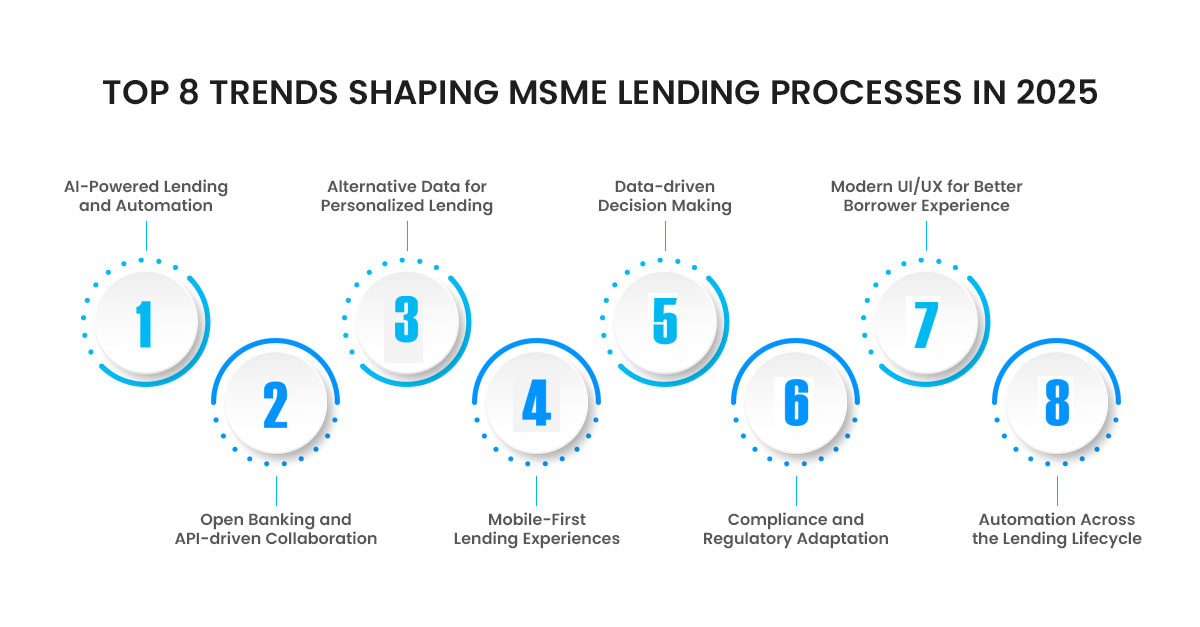

Top Trends Shaping MSME Lending Processes in 2025

As lenders strive to meet the demands of a fast-changing market, eight key trends are driving innovation and transformation in the MSME lending sector:

1. AI-Powered Lending and Automation

AI continues to transform MSME lending processes by improving decision-making, risk assessment and operational efficiency. Banks in India are leveraging AI-driven tools like chatbots, virtual assistants and predictive analytics to offer real-time support, detect fraud and accelerate loan approvals. This results in faster, more accurate credit decisions and better borrower experiences.

2. Open Banking and API-driven Collaboration

Open banking is enabling seamless collaboration between banks, fintechs and other financial institutions by sharing financial data securely and with borrower’s consent. This trend is opening new revenue streams and improving operational efficiency. Application Programming Interfaces (APIs) allow easy data exchange between lending platforms and credit bureaus, simplifying credit assessments and approvals.

3. Alternative Data for Personalized Lending

Traditional credit scoring methods often exclude MSMEs with limited financial histories. Lenders are now turning to alternative data sources to assess creditworthiness. By incorporating alternative data, lenders can create custom loan products and make credit accessible to more borrowers. This approach improves approval rates and repayment outcomes.

4. Mobile-First Lending Experiences

With the widespread use of smartphones, mobile lending has now become a critical channel for MSME financing. Lenders are investing in mobile-friendly platforms that offer intuitive user interfaces, responsive designs and simplified loan application processes. Borrowers can now apply for loans, upload documents, and receive funds directly through their mobile devices, making access to credit faster and more convenient. This trend is particularly significant in India, where mobile penetration continues to rise across urban and rural areas.

5. Data-driven Decision Making

Lenders are increasingly leveraging data analytic tools to gain deeper insights into borrower behaviour, market trends and portfolio performance. These tools help lenders make informed decisions, optimise lending strategies and mitigate risks. Data-driven decision-making enables lenders to proactively identify potential defaults, tailor financial products and enhance operational efficiency.

6. Compliance and Regulatory Adaptation

With digital lending rising, regulatory compliance remains a top priority for financial institutions. The Reserve Bank of India (RBI) has introduced stringent guidelines around data localization, customer consent management and risk mitigation. Lenders are investing in regulatory-compliant technologies to ensure they meet regulatory requirements while maintaining operational efficiency. Automation and AI-driven compliance monitoring tools are helping lenders stay ahead of regulatory changes and avoid penalties.

7. Modern UI/UX for Better Borrower Experience

User-friendly designs are now a must. Borrowers expect smooth, hassle-free interactions and lenders are responding with intuitive dashboards and personalised features that reduce application abandonment and build loyalty.

8. Automation Across the Lending Lifecycle

Automation is streamlining the entire lending process, from application to disbursement and collections. Automated underwriting systems, AI-driven credit scoring and workflow automation tools are reducing manual intervention, accelerating approvals and ensuring accuracy. For lenders, this means scaling operations efficiently while focusing more on customer relationships.

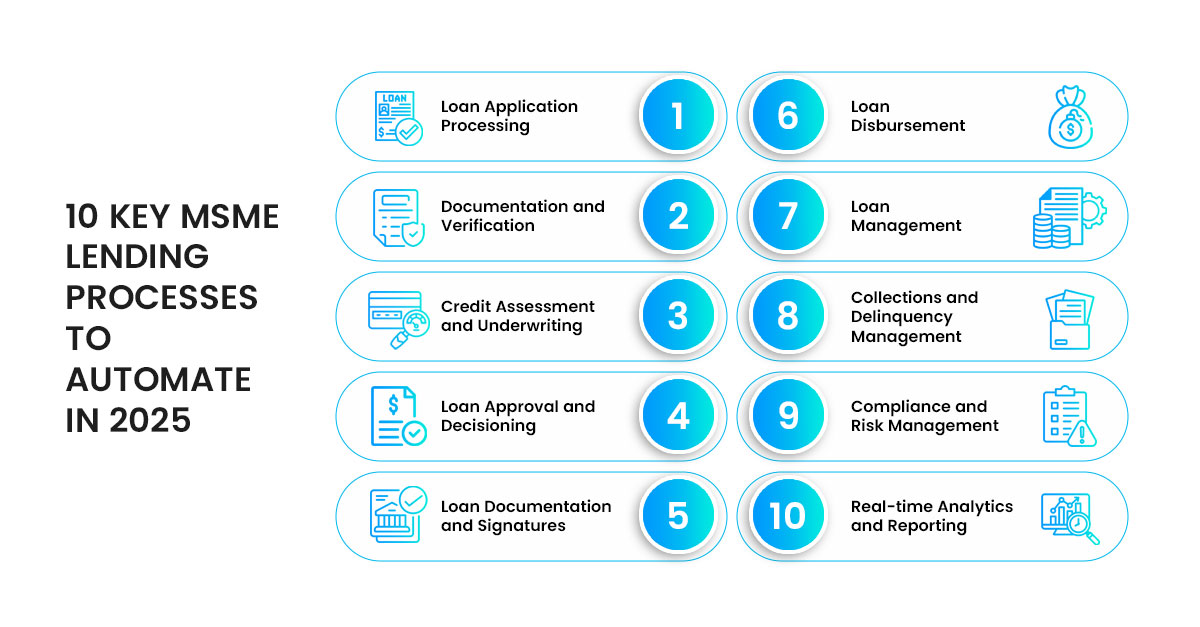

Key MSME Lending Processes to Automate

Automation isn’t just a trend, it’s a necessity. By streamlining critical processes, lenders can improve efficiency, minimise errors and improve customer satisfaction. Here are the areas where automation makes the biggest impact:

1. Loan Origination and Application Processing

Manual loan applications often involve extensive paperwork, data entries and verification, leading to delays and inefficiencies. Automating this process allows borrowers to submit applications online through user-friendly platforms. Automated systems can collect, validate and integrate data from various sources, reducing manual effort and improving processing speed. Intelligent form-filling tools and document uploads further streamline application submission, ensuring accuracy and regulatory compliance.

2. Documentation and Verification

Managing borrower documentation manually is time-consuming and error-prone. Automation tools equipped with Optical Character Recognition (OCR) can extract data from documents and verify with trusted sources. This speeds up the verification process and ensures data accuracy. Automated systems can also flag inconsistencies, enabling lenders to make faster, informed decisions about loan applications.

3. Credit Assessment and Underwriting

Automated underwriting systems use AI-driven algorithms to analyse credit scores, income patterns and risk factors with better accuracy and speed. These systems apply predefined rules and data-driven insights to provide consistent, objective and faster credit decisions, reducing manual underwriting effort and improving loan turnaround times.

4. Loan Approval and Decisioning

Automated credit decisioning tools evaluate borrower eligibility based on risk models and lending criteria, expediting the approval process. AI-powered decision engines analyse multiple data points to assess risk accurately and provide real-time loan approvals or rejections. This minimisess subjectivity in decision-making, ensuring transparency and consistency while enhancing borrower satisfaction.

5. Loan Documentation and Signatures

Manual loan documentation process can lead to delays and errors. Automation enables lenders to generate pre-populated, customized loan documents based on borrower data. E-signature solutions allow borrowers to sign agreements remotely, eliminating the need for physical paperwork and speeding up loan finalisation.

6. Loan Disbursement

Automated disbursement processes, such as electronic fund transfers, ensure fast and accurate transactions. These systems can be integrated with banking networks and payment platforms to facilitate secure and instant fund transfers, reducing manual intervention and transaction errors.

7. Loan Management

Managing loan accounts manually can be resource-intensive and prone to errors. Automated loan servicing platforms handle payment processing, account updates and borrower communication, ensuring timely reminders and accurate record-keeping. It also helps track loan performance, update account details and offer flexible repayment schedules based on borrower needs.

8. Collections and Delinquency Management

Automated collections systems streamline payment follow-ups by sending alerts and reminders for upcoming or overdue payments. Intelligent algorithms identify potential defaulters early, allowing lenders to take proactive measures to mitigate risks. Automated workflows can trigger repayment plans, restructuring options or escalation processes based on borrower behaviour.

9. Compliance and Risk Management

Automation helps monitor compliance by tracking document submissions, generating audit reports and adhering to regulatory guidelines. AI-driven compliance tools can automatically update policies and provide alerts on potential risks or non-compliance, reducing manual oversight.

10. Real-time Analytics and Reporting

Analytics tools generate real-time reports on loan performance, risk exposure and customer behaviour. These reports provide valuable insights to improve lending strategies, streamline operations and identify improvement areas. Data visualization dashboards help lenders track key metrics and make informed decisions.

The future of MSME lending: Automation for Growth

As competition intensifies and margins shrink, adopting intelligent lending platforms is no longer an option but a necessity. Lenders that adopt automation and data-driven decision-making will be well-positioned to stay ahead in an increasingly competitive lending landscape. Automating critical processes such as loan origination, underwriting and servicing allows lenders to reduce manual effort, minimises errors and accelerate loan approvals. It ensures compliance, improves risk management and provides a seamless borrowing experience.

Financial institutions that leverage these trends will optimise operations, build stronger relationships and provide personalized, customer-centric lending solutions.

CredAcc’s end-to-end MSME lending software platform is the perfect purpose-driven solution for Indian Banks and NBFCs looking for clear differentiators. Our platform automates the entire lending lifecycle, from loan origination to collections, empowering lenders with advanced credit evaluation tools, seamless integrations and enhanced operational control. With CredAcc, lenders can now achieve faster loan approvals, better risk management, improved customer satisfaction

Ready to future-proof your lending operations? Book a demo today.