As an MSME lender, choosing the right unsecured business lending software is crucial for streamlining operations, mitigating risks, and improving the borrower experience. Many MSMEs struggle with long approval times, which can delay critical business decisions and impact cash flow.

With digital lending leading the way, especially in fast-emerging economies such as India, MSME borrowers now expect a fully digital, hassle-free process, from applications to disbursements, completed in hours rather than weeks. In such a competitive market, the ability to make faster, more accurate lending decisions can be a true differentiator, improving efficiency and customer satisfaction. When selecting the best unsecured business lending software, understanding the key features to prioritize will help avoid costly mistakes and ensure that the software scales with evolving business needs.

What is Unsecured Business Lending?

Unsecured business lending refers to loans provided to businesses without collateral. Instead, lenders assess risk based on the borrower’s creditworthiness, credit reports and other financial indicators. This form of lending is particularly beneficial to MSMEs that may lack collateral but need capital to grow or manage cash flow.

Unlike secured lending, where loans are backed by collateral that lenders can claim in case of default, unsecured business lending carries higher risk. As a result, lenders must evaluate borrowers based on their financial stability, credit history, and business performance.

Challenges in Unsecured Business Lending

While unsecured business lending offers significant advantages for both lenders and borrowers, it also presents unique challenges, such as:

- Absence of Collateral: Without physical assets as security, lenders have no fallback in case of default, complicating risk management.

- Higher Risk Exposure: Because unsecured loans lack collateral, lenders must rely heavily on borrower’s creditworthiness and business financials, which can be difficult to evaluate accurately, especially for newer businesses.

- Complex Risk Assessment: Assessing a borrower’s financial health without collateral requires advanced data analytics and scoring models that factor in subjective parameters like cash flow, revenue projections, and industry trends.

- Longer Approval Times: Thorough borrower evaluations can extend processing times, frustrating those seeking quick access to capital.

- Higher Interest Rates: To offset the increased risk, lenders may charge higher interest rates, making unsecured loans costlier for smaller businesses with limited financial history.

Unsecured Business Lending Software – Key Features to look for

The right unsecured business lending software should enhance speed, accuracy and efficiency while addressing the challenges of unsecured lending. Key features to prioritize include:

- Automation of Loan Processing: End-to-end automation of application, borrower verification, risk assessment, disbursement, and management will reduce manual errors, accelerate decisions, and enable faster loan approvals.

- Advanced Risk Scoring Models: The software must integrate advanced risk scoring models, considering factors such has financial statements, GST data, bank statements, credit scores, and payment history. These models help you make informed, consistent lending decisions.

- Real-Time Data Analytics and Reporting: Real-time reporting enables lenders to monitor loan performance, assess borrower risk and refine lending strategies. Customizable dashboards and automated reports offer lenders a clear view of their portfolio’s performance and risks.

- Seamless Integration with Third-Party Systems: Integration with third-party systems such as CRM platforms, digital signing tools, and credit bureaus is important. This ensures a smooth data flow and a unified platform to manage the complete loan process, enhancing workflow efficiency and providing a 360° view of borrower information.

- Compliance and Security Features: The software must ensure compliance with local, regional and global regulations. Built-in security features such as data encryption and audit trails will protect borrower information and meet all legal requirements.

- Customer-Centric Interface: A mobile-friendly, intuitive platform with real-time application updates is a must to enhance the borrower experience.

- Scalability: The software should accommodate increasing loan volumes, additional users and complex workflows without compromising performance.

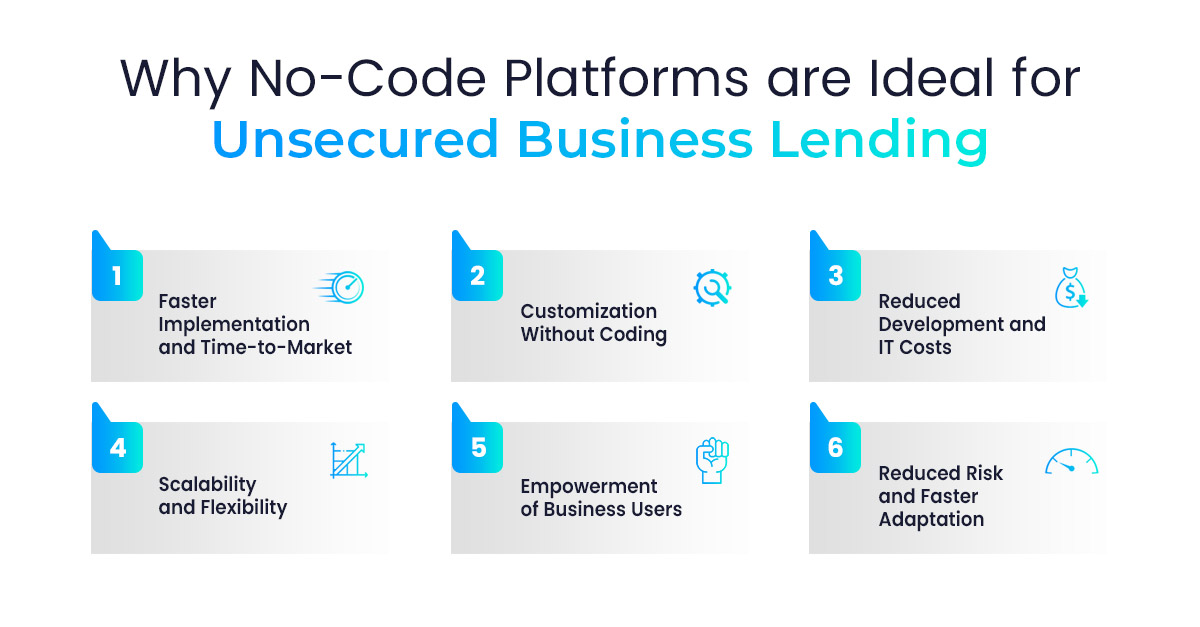

Why No-Code Platforms are Ideal for Unsecured Business Lending

Managing unsecured business lending requires speed, flexibility and adaptability. No-code provide these benefits, enabling lenders to streamline processes without relying on IT resources. By allowing lenders to customize workflows, integrate with existing systems and scale as the business grows, no-code platforms make it easier to manage unsecured loans while reducing costs and risks.

Here’s why a no-code platform is the ideal choice for your unsecured business lending operations:

- Faster Implementation and Time-to-Market: No-code platforms significantly reduce deployment time, ensuring quicker go-to-market for unsecured business loans. Lenders can launch new lending products and features much faster, helping them stay competitive and meet borrower needs in record time.

- Customization Without Coding: Lenders can configure loan workflows, approval processes and borrower communication without requiring technical expertise. Through an intuitive, drag-and-drop interface, lenders now have the flexibility to fine-tune their lending operations.

- Reduced Development and IT Costs: A no-code environment eliminates the need for expensive IT teams, saving both upfront development costs and long-term maintenance, as no-code solutions are easier to update and manage. This allows lenders to reallocate resources to other key areas of the business.

- Scalability and Flexibility: They can handle increased loan volumes and complex workflows without compromising performance. Lenders can easily adapt the platform to new markets, products, and borrower demands, ensuring that the software scales in-line with the business.

- Empowerment of Business Users: Lenders gain control over loan product creation, workflow adjustments and borrower experience enhancements, without any dependency on external resources.

- Reduced Risk and Faster Adaptation: A no-code solution enables rapid adjustments in response to regulatory updates, industry trends or customer demands.

Conclusion and Next Steps: Choosing the Right Unsecured Business Lending Software

Choosing the right unsecured business lending software is a key decision that can significantly impact your lending operations. MSME borrowers today won’t wait – they expect a fully digital, hassle-free process, with applications and disbursements completed in hours, not weeks.

At CredAcc, we understand the complexities of unsecured business lending. Our no-code LOS & LMS is designed to simplify and accelerate your lending process, from application to repayment. With CredAcc, you can automate your workflows, leverage powerful risk-scoring models, and integrate seamlessly with third-party systems, allowing you to deliver faster decisions and better service to your MSME borrowers.

If you are a Bank or NBFC looking to modernize your unsecured business lending operations, request a demo today.