How no-code digital lending platforms in India are transforming MSME lending for Banks & NBFCs

Lenders have often faced a crucial decision when implementing digital lending software: whether to build a custom solution in-house or buy an off-the-shelf product. Both come with their own pros and cons. Building digital lending software from scratch provides complete control and customization but demands significant time, resources and expertise. On the other hand, buying a ready-made product offers faster deployment and cost savings but often lacks the flexibility to address unique business needs.

But what if there is a third option?

Today, no-code platforms are changing the way financial institutions address the build vs. buy dilemma. These platforms enable lenders to develop custom solutions without the complexities of the traditional development approach. They bridge the gap between the limitations of pre-built software and the resource-heavy nature of custom development, enabling faster implementation, lower costs and greater adaptability.

With the no-code approach, lenders can now streamline loan origination, onboarding, underwriting, management, collections and compliance processes- without lengthy development cycles or heavy IT involvement. This approach empowers businesses to take control of their digital lending transformation projects, ensuring their software evolves as per their needs.

This article explores the pros and cons of building, buying and leveraging no-code digital lending software platforms, helping readers make an informed decision that aligns with their organization’s goals.

Is no-code the perfect middle ground? Let’s explore.

What is Build vs Buy?

Lending technology requirements have become increasingly complex. Today, lenders don’t just need software to process applications – they require systems that can adapt to evolving regulations, integrate with multiple external systems, and provide a seamless borrower experience. This demand for flexibility and scalability has intensified the debate between building and buying software.

Building Software

Building software involves developing a custom solution tailored to an organization’s specific needs. This requires engineering expertise and resources to design, deploy and maintain the solution. It offers maximum flexibility, allowing businesses to customize the software according to their unique workflows and requirements.

Buying Off-the-Shelf Software

Buying software refers to purchasing a ready-made, “out-of-the-box” solution designed by a vendor to address specific business needs. These solutions are quick to deploy and require minimal customization, making them suitable for well-defined problems but less adaptable for unique requirements. Off-the-shelf options typically often come in the form of point solutions that focus on improving certain business functions, such as loan origination or collections management. While these solutions are easy to adopt and require minimal coding, they may not always integrate seamlessly with existing systems, potentially leading to operational inefficiencies.

Building Software – Pros and Cons

Custom-built lending software allows lenders to design solutions tailored to their exact needs. However, this approach requires significant resources and expertise. Here’s a closer look at the pros and cons:

Pros:

- Customization and Flexibility: In-house software development offers complete control over features and workflows, ensuring alignment with business operations. Customization also allows lenders to adapt quickly to evolving regulatory requirements and market conditions.

- Competitive Advantage: A bespoke system can provide a unique market differentiator, offering tailored features that improve borrower experience and operational efficiency. Proprietary systems can help businesses stand out by offering unique capabilities that off-the-shelf products lack.

- Full Control over Development: Lenders can prioritize updates without dependency on external vendors, ensuring greater flexibility in adapting to business changes.

- Intellectual Property (IP) Ownership: Businesses can retain ownership of the technology, proprietary processes and data, ensuring long-term value and security.

Cons:

- High Costs and Resource Demands: Custom software development requires substantial investments in talent, infrastructure and ongoing support, often leading to cost overruns. These expenses may extend beyond the initial build, covering continuous updates and maintenance.

- Talent Shortages: Finding and retaining skilled developers with the expertise in building complex lending platforms is a significant challenge. Internal teams may require additional training, pulling focus away from core business functions.

- Scalability Challenges: A custom-built solution might not scale easily with business growth, requiring additional development efforts. Evolving regulatory and market demands may also require frequent, costly updates.

- Ongoing Maintenance and Compliance: Internal teams must handle software upgrades, security patches and compliance requirements, which can be time-consuming and resource-intensive. Failure to keep up with regulatory changes could expose the business to operational and financial risks.

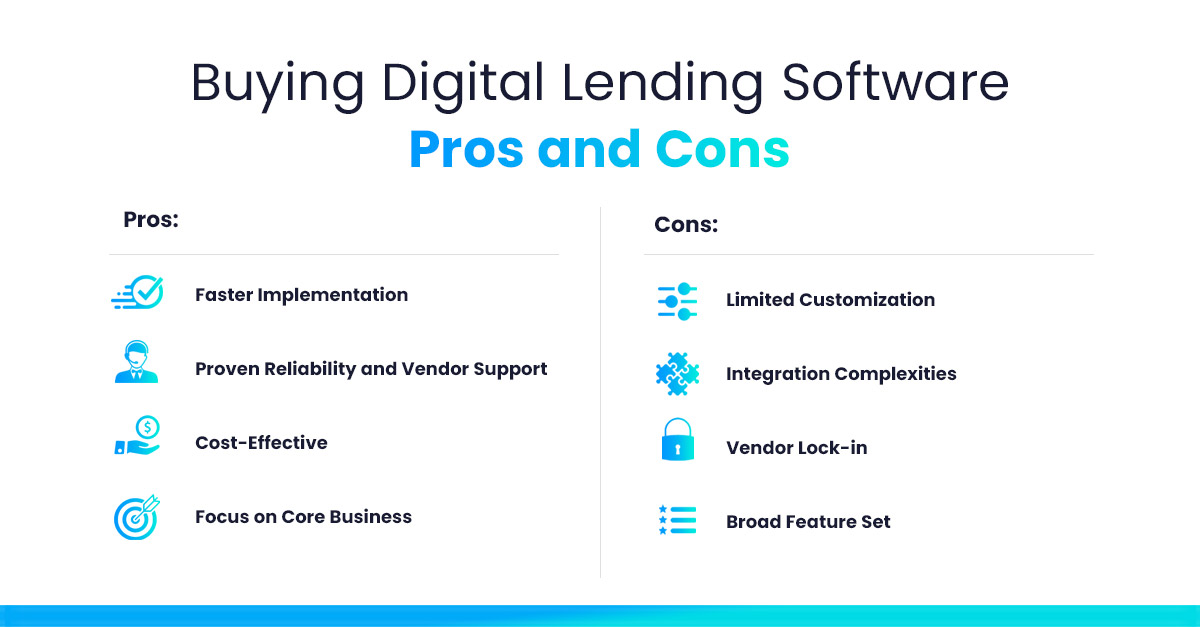

Buying Digital Lending Software – Pros and Cons

Off-the-shelf lending solutions provide quick, cost-effective way to implement technology without the complexity of custom development. However, this convenience may come at the expense of flexibility and long-term scalability. Here’s a closer look at the benefits and limitations of buying software:

Pros:

- Faster Implementation: Ready-to-use lending solutions can be deployed quickly, minimizing disruption to business operations. Time-to-market is a significant advantage in the lending industry.

- Proven Reliability and Vendor Support: Vendor-developed solutions are stable, compliant and backed by ongoing support.

- Cost-Effective: Eliminates upfront development costs, with vendors managing updates and security.

- Focus on Core Business: Allows lenders to focus on strategic growth instead of IT management. This allows them to prioritize improving customer experience and expanding their market reach.

Cons:

- Limited Customization: One-size-fits-all solutions may not fully align with unique workflows. Customization options are often restricted, limiting the ability to create differentiated user experiences.

- Integration Complexities: Pre-built platforms may not seamlessly integrate with existing systems, requiring additional efforts and costs for customization. Compatibility issues with legacy systems can result in operational challenges.

- Vendor Lock-in: Relying on vendors for updates and enhancements can lead to delays. Changes in vendor policies or pricing structures could impact long-term strategy and budgeting.

- Broad Feature Set: Generic solutions may include unnecessary features while lacking critical functionalities. Lenders may need to adapt their processes to fit the software rather than the other way around.

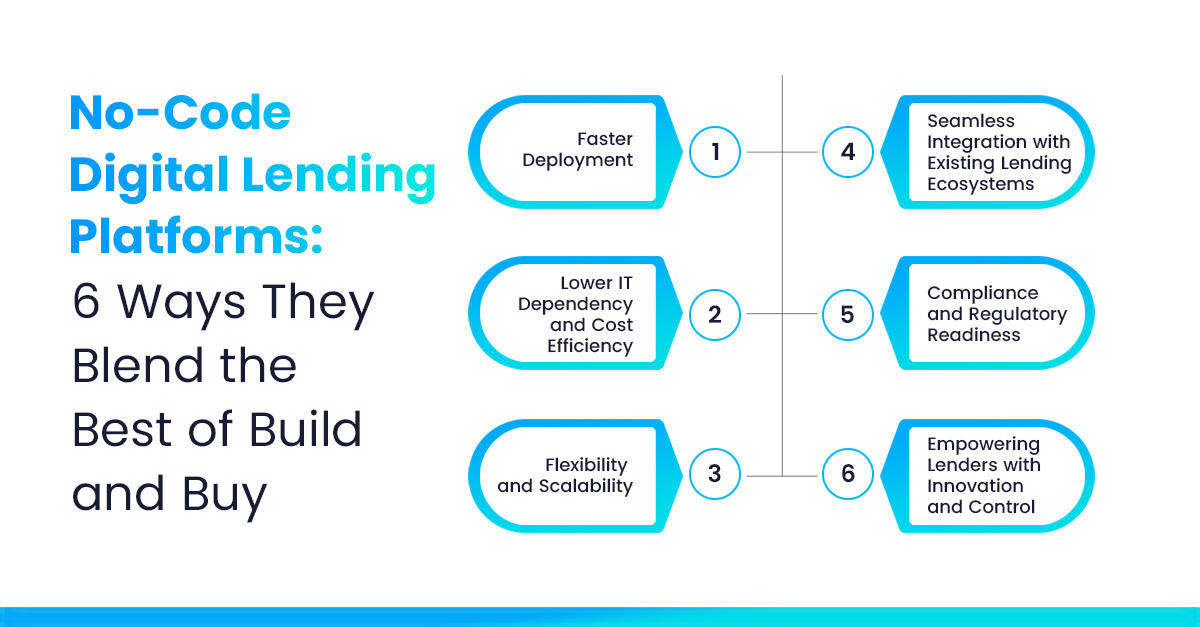

No-Code Digital Lending Platforms: Combining the best of Build and Buy

No-code digital lending platforms offer a hybrid approach, enabling lenders to create tailored solutions quickly and affordably. Here’s how they combine the advantages of building and buying:

Faster Deployment: Traditional software development can take months or years. No-code platforms accelerate this process using pre-built components, drag-and-drop interfaces and automated workflows. For instance, lenders can launch new loan products within weeks, responding quickly to market demands.

Lower IT Dependency and Cost Efficiency: Building a digital lending system from scratch requires a significant investment in hiring skilled developers, maintaining infrastructure and ongoing updates. No-code platforms reduce this dependency by empowering non-technical teams, such as credit officers and operations staff, to build and manage lending processes themselves. This approach not only cuts down on development costs but also allows IT teams to focus on strategic priorities rather than routine system maintenance. According to Gartner, 70% of new applications developed by enterprises will use no-code or low-code platforms by 2025.

Flexibility and Scalability: Unlike rigid off-the-shelf solutions, no-code platforms allow customization of loan origination, servicing and collection workflows. As operations scale, these platforms adapt to higher volumes and evolving regulatory requirements seamlessly.

Seamless Integration with Existing Lending Ecosystems: Lenders often struggle with integrating new software into their existing tech stack, which includes credit bureaus, core banking systems, payment gateways and more. No-code platforms offer API-driven architectures, enabling easy integration with third-party services and existing systems. This enhances data flow, improves borrower experience and drives operational efficiency.

Compliance and Regulatory Readiness: No-code platforms offer built-in compliance features that can be easily updated to align with regulatory changes. This reduces risks and ensures compliance with local and global lending regulations without costly updates or manual work.

Empowering Lenders with Innovation and Control: No-code promotes innovation by allowing teams to experiment with loan products and repayment models. This agility helps lenders stay competitive in a fast-changing market.

Embracing the Future of Lending with No-Code

While the build vs. buy is not a straightforward decision for many lenders, each with its inherent pros and cons, no-code is fast emerging as a suitable choice given its vast potential and capabilities. It bridges the gap between the two, offering the flexibility of building with the efficiency of buying. No-code platforms enable rapid deployment, easy scalability and seamless integration with existing systems – all while reducing costs and IT dependency.

This hybrid approach allows lenders to strike the right balance – leveraging pre-built functionalities while customizing features to suit their specific operational and regulatory needs. It empowers lenders to stay agile, competitive and future-ready without compromising efficiency or innovation.

For Indian MSME lenders, CredAcc’s end-to-end no-code Loan Origination & Loan Management System is the perfect solution that provides an ideal balance of customization and compliance. It helps lenders address unique challenges, scale rapidly and drive growth in an evolving financial landscape.

Ready to know about how a ‘build and buy’ approach can enhance your lending platform? Get in touch with our team today to explore a tailored solution that offers the perfect balance of flexibility and efficiency.

Frequently Asked Questions (FAQs) About Digital Lending Platforms in India

Digital lending refers to the process of offering loans through online platforms, leveraging technology to automate and streamline the entire lending lifecycle—from application and underwriting to disbursement and collections. It eliminates manual paperwork, enhances efficiency, and provides a seamless experience for borrowers and lenders.

A digital lending platform automates various lending processes such as borrower onboarding, document verification, credit assessment, loan approval, and repayment tracking. It integrates with financial institutions, credit bureaus, and payment systems to enable quick and accurate lending decisions.

A digital lending platform in India offers several benefits, including:

• Faster loan approvals and disbursals

• Reduced operational costs through automation

• Enhanced borrower experience with seamless onboarding

• Improved risk assessment using data analytics

• Better compliance with regulatory requirements

A digital lending system helps banks and NBFCs by automating loan origination, underwriting, and management. It allows lenders to scale their operations, reduce manual intervention, and make data-driven lending decisions while ensuring regulatory compliance.

Building a digital lending software allows lenders to create a customized solution tailored to their specific needs but requires significant time and resources. Buying an off-the-shelf solution offers faster implementation and cost savings but may lack flexibility. No-code digital lending platforms provide a hybrid approach, combining the best of both options with customization and speed.